ACA Compliance

Collaborate with

Benefit Provider

IRS Reporting

& Filings

Legal

Answers & Advice

Affordable Care Act

The Affordable Care Act (ACA) was initiated to “increase the number of Americans covered by health insurance and decrease the cost of health care.” While somewhat controversial, one thing we can all agree in is that the ACA is complicated! We also know compliance is critical in order to avoid fines and penalties.

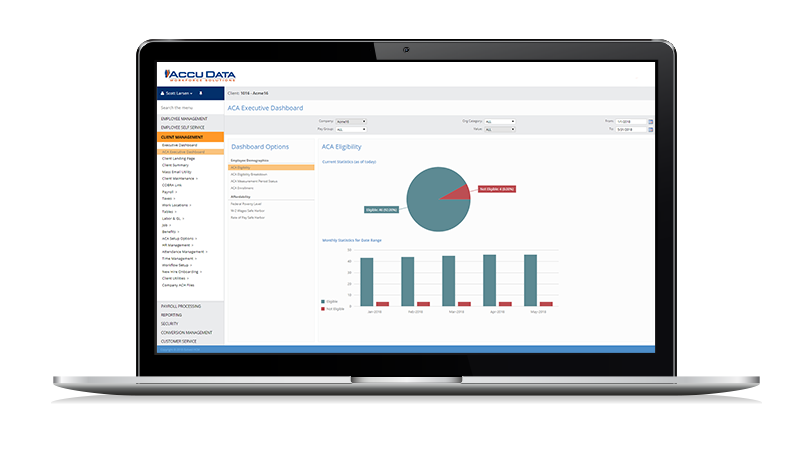

Accu Data can help get you through the maze of ACA regulations, requirements, and terminology, with our cloud-based software solution, which includes all the tools you need to remain compliant and all the information you need to manage your employees.

ACA Compliance Made Simple

Accurate workforce data is vital to your compliance. With our solution, all of your employee and benefit information is housed in a single source and can complete the Section 6055 and 6056 forms and other reporting to comply with ACA requirements.

- ALE test to calculate FTEs and determine ALE status

- Look-back reporting for employee ACA status and benefit eligibility

- Affordability report and projection tools

- Applicable 1094, 1095, and annual 1095-C forms

Does Your Company Have To Comply?

If your company is an Applicable Large Employer (ALE)—a business that has 50 or more full-time equivalent employees—you are required to offer minimum essential coverage that is both affordable (9.5% income) and provides minimum value (paying at least 60% of costs). If you fail to offer minimum essential coverage, you face a penalty called the Assessable Payment.

If you offer full-time employees coverage that is deemed unaffordable (at least 9.5% of the employee’s income for the least expensive employee-only, compliant plan) or don’t provide minimum value (the plan’s share of total cost of benefits under the plan is less than 60%), you may face a penalty of $3,000 for each full-time employee receiving a subsidy for exchange coverage. Employers who file incorrect forms may be subject to a fine of $50 per form up to $250,000 annually.

The Accu Data Difference

Technology

We're committed to staying at the forefront of the technology used in our industry. We offer comprehensive, completely scalable HCM software, designed to make workforce management easier and more productive.

Service

We pride ourselves on the professional and personal service we provide to our clients. We pay meticulous attention to detail, and to you, with a continual focus on accuracy, efficiency, data visibility and creating a highly engaged workforce.

Cost

Accu Data provides our clients with cost-effective solutions and services – from audit-controlled processing to cloud-based software – at an affordable cost with no big spends on hardware or licensing fees.