Calculating Payroll for Tipped Restaurant Employees in New York State

Running a successful restaurant is a lot like putting on a huge Broadway production – every single day! The stage, the props, the players, the lights and music; there are a million details. In your case, there’s the food and drink, hosts and hostesses, the servers and the kitchen crew. And you never know how many patrons will show up. That’s why when it comes to employee payroll, you don’t need any more surprises.

Navigating overtime laws can be challenging at best, and juggling a bunch of workers who have differing shifts and are paid at separate rates can be a real headache. You need to have a firm grasp on how to pay tipped employees correctly in order to avoid payroll or tax problems down the line. The following charts – specific to New York State – should be very helpful!

New York State Minimum Wage

Minimum wage changes for New York

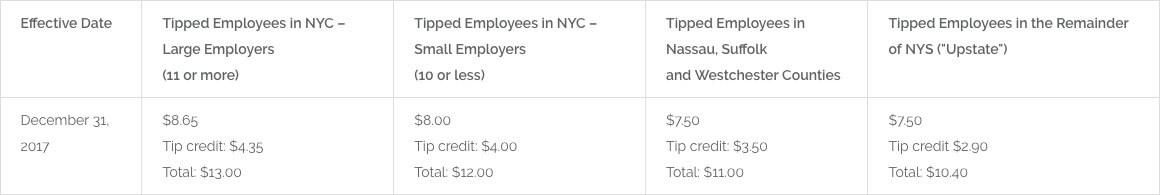

Minimum wage for TIPPED employees

Minimum wage for fast food workers

New York State Overtime for Tipped Restaurant Employees

Determining overtime pay for tipped employees is different from employees receiving a regular hourly wage without tips. It can all seem a bit confusing. So, here is information that should make it a bit easier.

NYC Large Employer (11 or more employees)

- Hourly overtime pay: $ 13.00 x 1.5 = $19.50 per hour

- Tip credit: $4.35

- Tipped OT rate = $ 19.50 – $4.35 = $15.15 per hour

NYC Small Employer (10 or less employees)

- Hourly overtime pay: $ 12.00 x 1.5 = $18.00 per hour

- Tip credit: $4.00

- Tipped OT rate = $ 18.00 – $4.00 = $14.00 per hour

Employers in Nassau, Suffolk and Westchester Counties

- Hourly overtime pay: $ 11.00 x 1.5 = $16.50 per hour

- Tip credit: $3.50

- Tipped OT rate = $ 16.50 – $3.50 = $13.00 per hour

Employers in the remainder of NYS (upstate)

- Hourly overtime pay: $ 10.40 x 1.5 = $15.60 per hour

- Tip credit: $2.90

- Tipped OT rate = $ 15.60 – $2.90 = $12.70 per hour

An Accu Data Workforce Solutions representative can answer any questions you might have concerning the payment of tipped employees in the restaurant industry. We’re here to help!